Auto Insurance in and around Oak Brook

Oak Brook's first choice car insurance is right here

Let’s get this coverage on the road

Would you like to create a personalized auto quote?

Your Auto Insurance Search Is Over

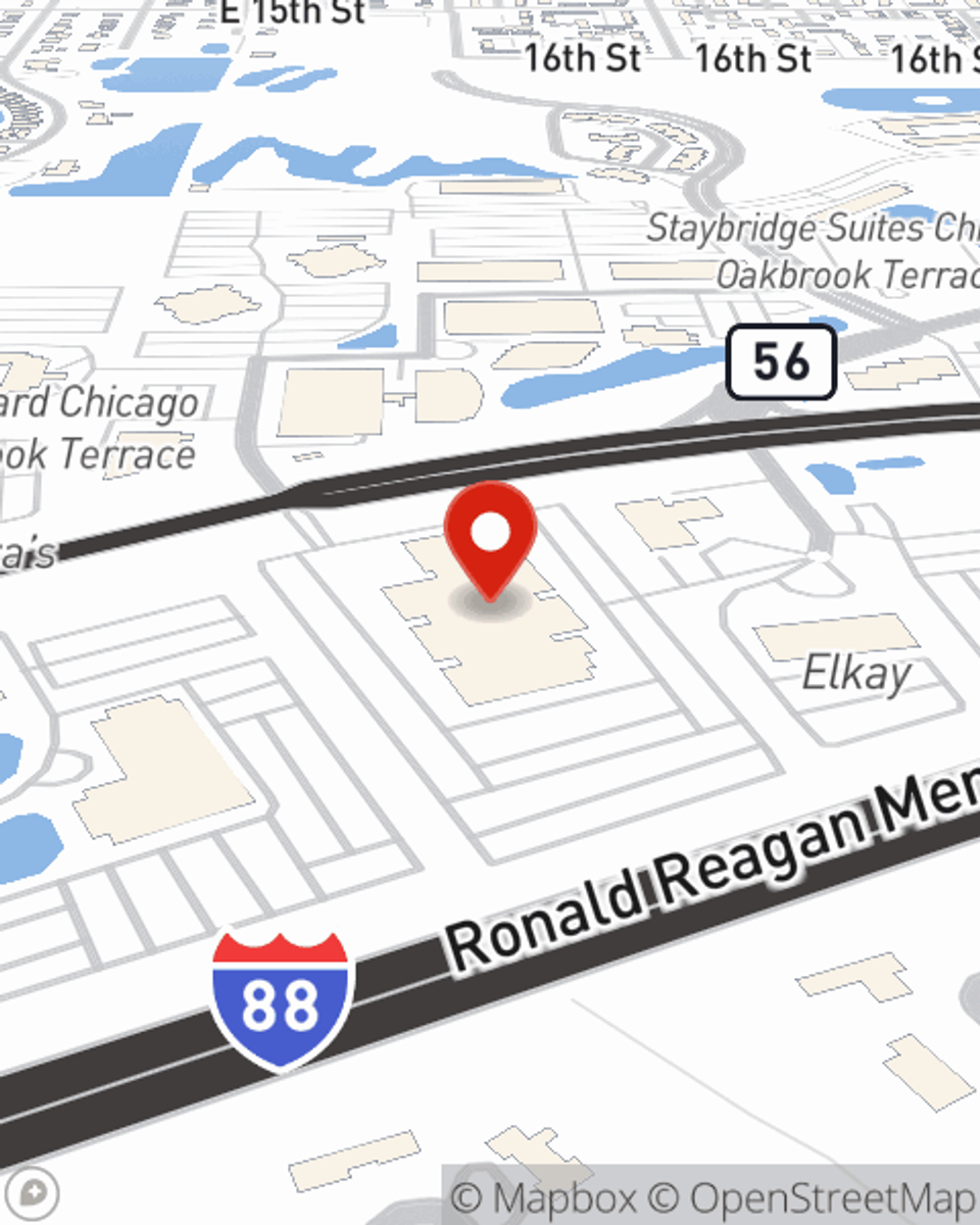

You want an agent who is not only a resource in the field, but who is also caring and attentive. That's State Farm Agent Bill Hepburn! Oak Brook drivers choose Bill Hepburn for a protection plan personalized for their particular needs, from a top provider of auto insurance.

Oak Brook's first choice car insurance is right here

Let’s get this coverage on the road

Great Coverage For A Variety Of Vehicles

With Bill Hepburn's assistance, you'll get reliable coverage for your vehicles, from pickup trucks to SUVs. And Agent Bill Hepburn can share more information about State Farm's savings options—such as our Drive Safe & Save™ and Safe Driver Program—and a wide range of policy inclusions—such as rideshare insurance and car rental insurance.

You don't have to ride solo when you have insurance from State Farm. Reach out to Bill Hepburn's office today for more information on the advantages of State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Bill at (630) 833-5424 or visit our FAQ page.

Simple Insights®

Bike to work? Boost your commuting safety

Bike to work? Boost your commuting safety

Bicycle commuting can be beneficial to your health as well as the environment. If you bike to work, learn how to stay safe on your two-wheel commute.

What is first party medical and PIP coverage?

What is first party medical and PIP coverage?

Personal Injury Protection (PIP) pays the reasonable and necessary medical expenses you and your passengers incur after an accident, regardless of fault.

Bill Hepburn

State Farm® Insurance AgentSimple Insights®

Bike to work? Boost your commuting safety

Bike to work? Boost your commuting safety

Bicycle commuting can be beneficial to your health as well as the environment. If you bike to work, learn how to stay safe on your two-wheel commute.

What is first party medical and PIP coverage?

What is first party medical and PIP coverage?

Personal Injury Protection (PIP) pays the reasonable and necessary medical expenses you and your passengers incur after an accident, regardless of fault.